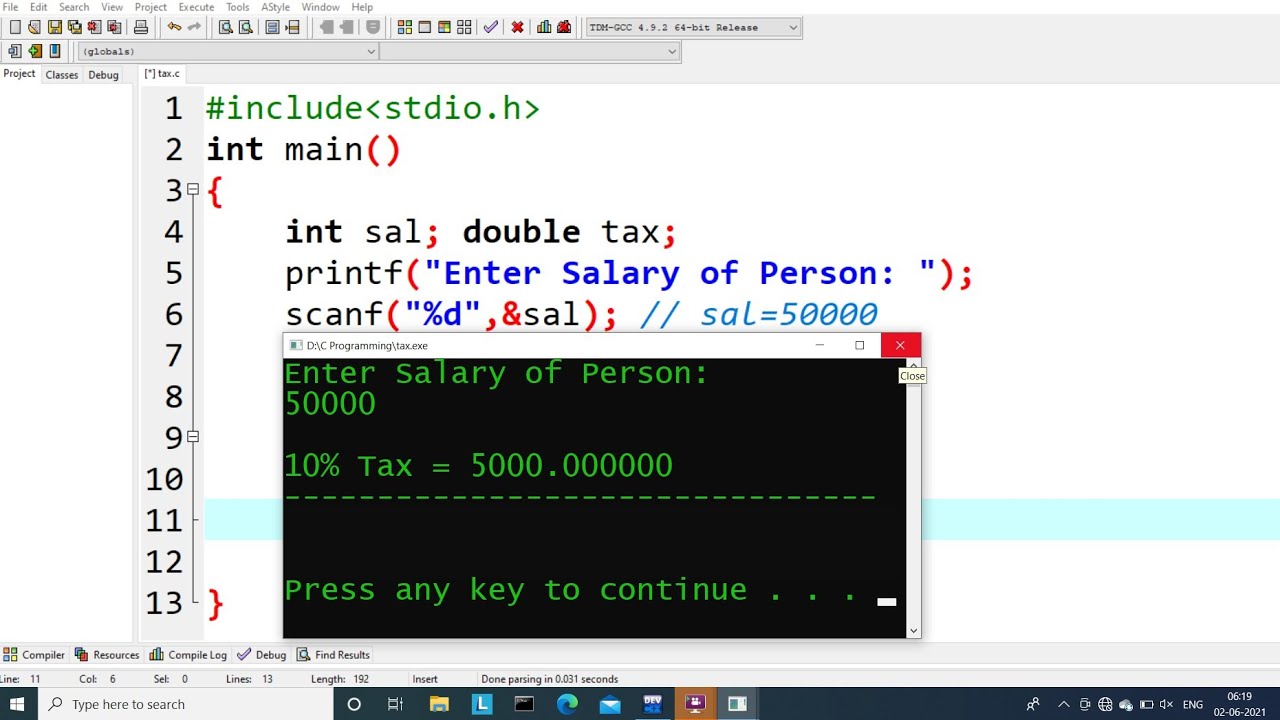

C Program to Calculate Income Tax

IRS Publication 598 Tax on Unrelated Business Income of Exempt Organizations. See the Departments circular note dated April 10 1991.

C Program To Calculate Tax On A Salary Learn Coding Youtube

For more detail regarding Corporate Income Tax calculation in.

. We have choosen the famous south indian food to create the following program. Imposition of net income tax. Payments and Credits Applied to Use Tax For taxable years beginning on or after January 1 2015 if an exempt organization includes use tax on its income tax return payments and credits will be applied to use tax first then towards franchise or income tax interest and penalties.

62 1 which refers to the federal Internal Revenue Code with certain modifications. With multiple items in a. Today let us write a code to calculate the restaurant bill.

Calculate Deductions and Taxable Income. 26 CFR 3017701-3. If you are employed.

Java code to calcuate the resturant bill the following program is pretty simple one along with sample outputs. 26 CFR 3017701-2. Part IV asks for information about a vehicle you used in your business.

Income tax information for A or G visa holders. If you were a student in 2021 this guide will give you helpful information about filing your 2021 Income Tax and Benefit Return. For more information see General Information L California Use Tax and Specific Line Instructions.

If taxable income is in the range 300001-500000 then charge 20 tax. Locally hired foreign mission employees If you are permanently resident in the United States for purposes of the Vienna Conventions you are not entitled to the income tax exemption available under the Vienna Conventions. Heres the breakdown of the incentive amounts for the purchase or lease of each vehicle type.

IRS Publication 542 Corporations. If taxable income is in the range 150001-300000 then charge 10 tax 3. Classification of certain business entities.

Income taxes are administered by the Canada Revenue Agency CRA. Annual Taxable Income Rate. Using Schedule C-EZ instead for tax years prior to 2019 Many sole proprietors were able to use a.

In this tutorial we can learn C program to calculate tax. 2 DefinitionsUnless the context requires otherwise for the purposes of 830 CMR 625A1 the following definitions apply. Java program to calculate Electricity billIf you wondering on how to calculate Electricity bill by writing the Java program there you go.

Forms to calculate your BC. If you are in Canada as an international student go to Taxes for International students studying in Canada or refer to our contact information at the end of this guide. If you were a student who was enrolled at a foreign university college or other post.

Calculate difference between D-EG 273000-257400 15600 Step 6. Income tax are included with the T1 Income Tax ReturnEven if you dont owe income tax you can file an income tax return to claim a refund credits or benefits. In this c program we enter a number and calculate tax with the given following conditions.

This is the figure you report on your income tax return. The next question you should be asking yourself is How do I figure my taxable income This step will help you find your taxable income after deductions. In Part III you calculate your cost of goods sold if applicable to your business.

Calculate tax payable on Current year salary in which arrears of salary is received excluding arrearsE 1450000 Tax on 1450000 is 257400 Step 5. Here we share the list of code with sample outputs in five different ways using static values using function or method using command line arguments do while for loop user define method along with sample outputs for each program. Benefit us 891 is G-C 15600-10300 INR 5300 Legal requirement to avail benefit us 891 Form 10E.

Code as defined in GL. For help figuring this out use our easy-to-use income tax calculator. We all go to restaurants frequently and eat.

If income is less thn 150000 then no tax 2. Once you report all of your income on your Form 1040 and Schedule 1 you will then have the. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

Individuals and households leasing or buying a new electric vehicle in BC. Are eligible for up to 4000 off the after-tax vehicle price thanks to the government of BCs CleanBC Go Electric program. Corporate trust any partnership association or trust the beneficial interest of which is represented by transferable shares.

The next amount over Rp. Part V is for any other eligible expenses not listed in Part II.

C Program To Calculate Tax On A Salary Learn Coding Youtube

C Program To Calculate Tax Given The Following Conditions Computer Notes

Comments

Post a Comment